des moines iowa sales tax rate 2019

Nineteen major cities now have combined rates of 9 percent or higher. The minimum combined 2022 sales tax rate for Des Moines Iowa is.

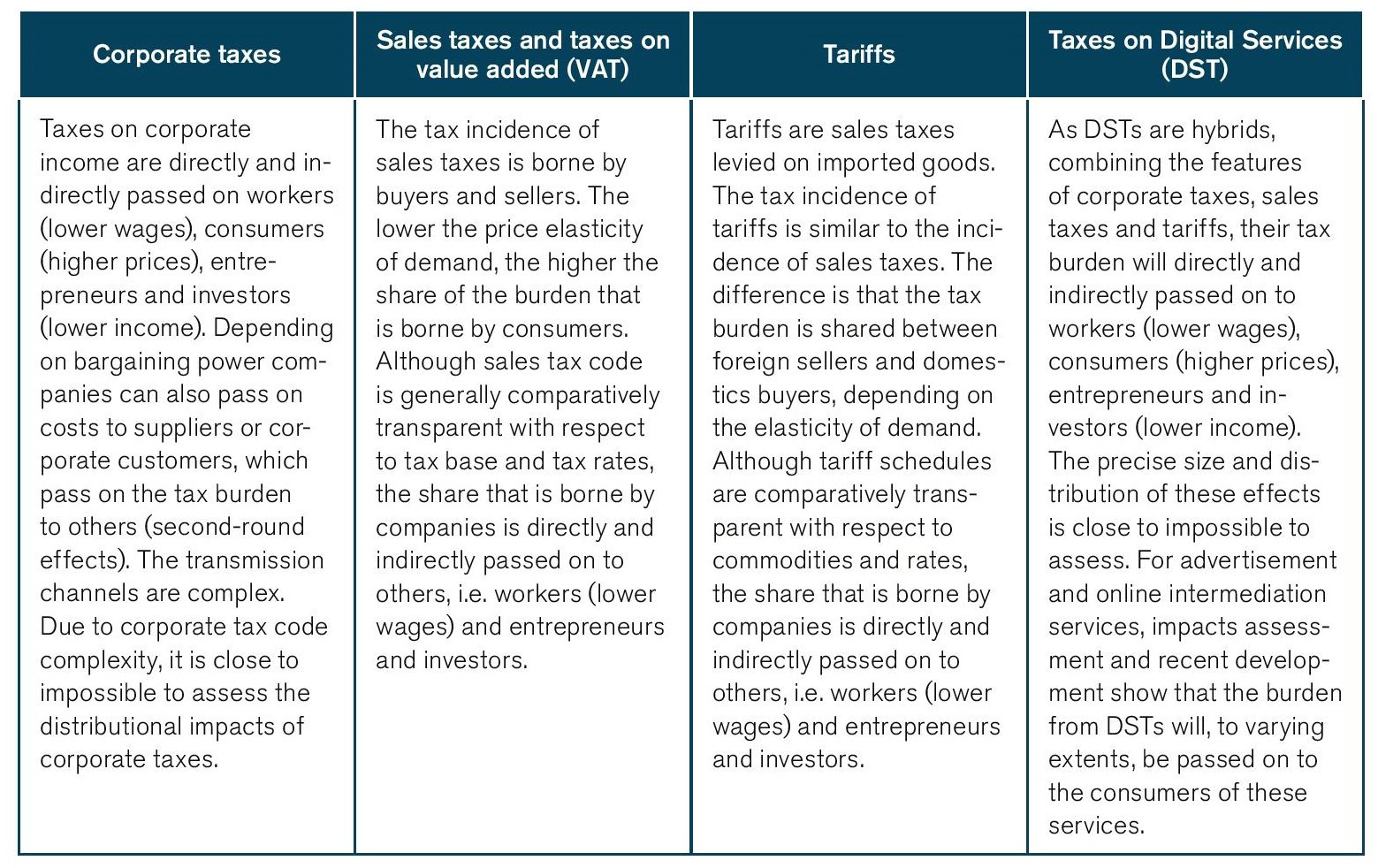

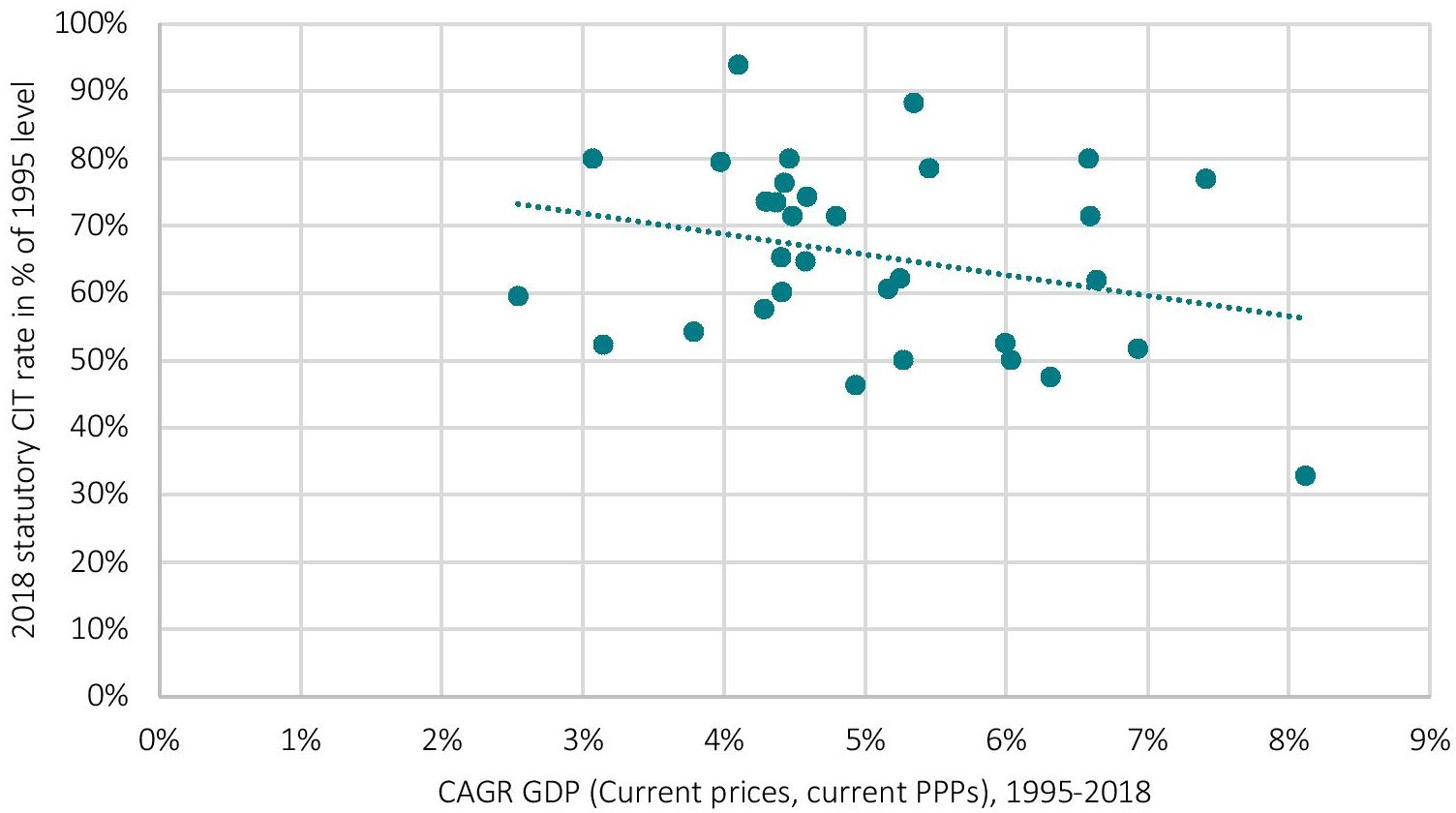

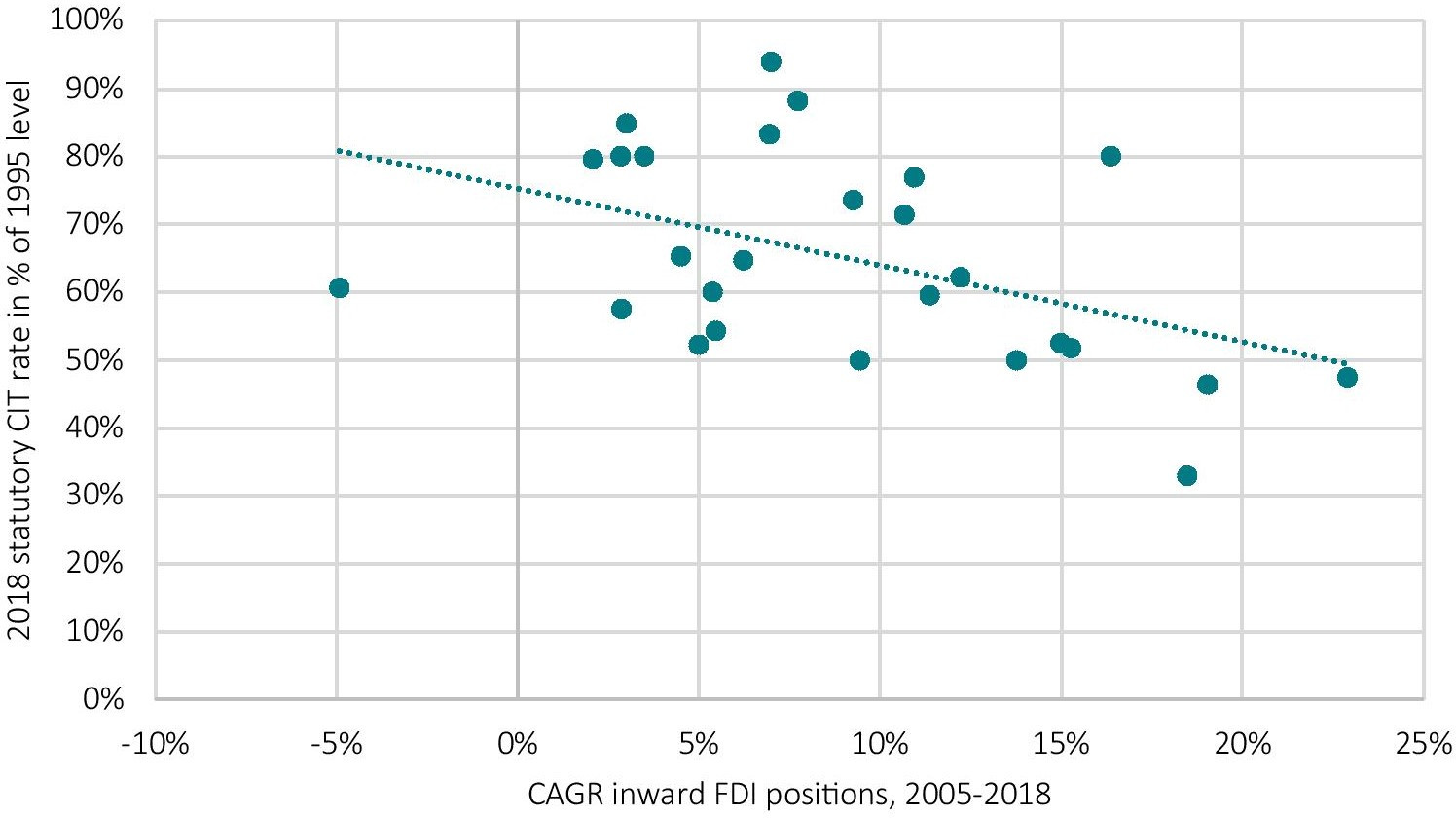

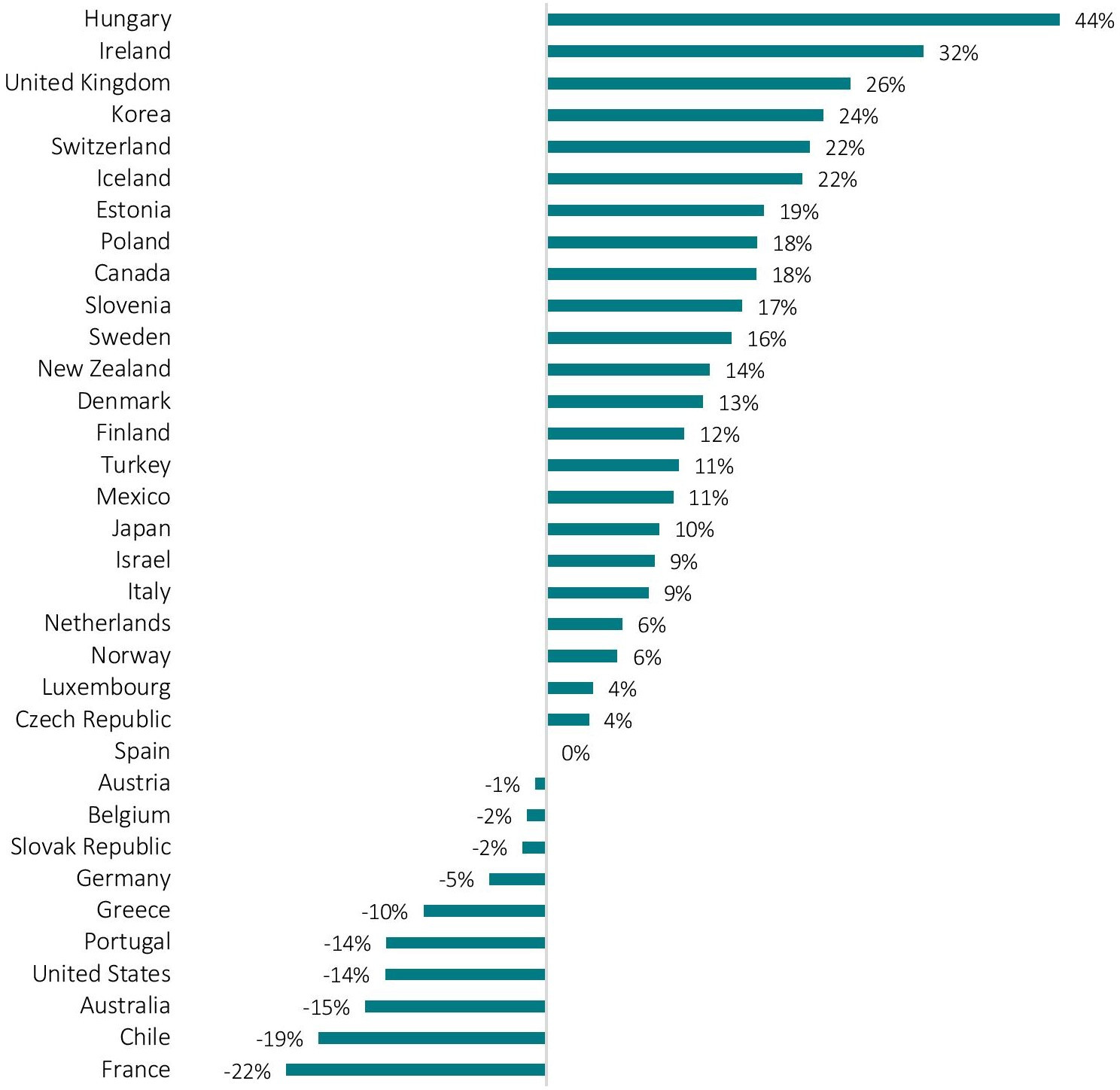

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

954 rows Lowest sales tax 45 Highest sales tax 7 Iowa Sales Tax.

. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent. State Sales and Use Tax. The Iowa sales tax rate is currently.

Real property tax on median home. Depending on local municipalities the total tax rate can be as high as 8. The new tax was approved by 70 percent of voters back in March and will generate roughly 37 million a year for property tax relief infrastructure upgrades public safety enhancements and neighborhood improvements.

This is the total of state county and city sales tax rates. Fort Dodge IA Sales Tax Rate. Des Moines Iowa The Iowa Department of Revenue has announced the 2019 interest rate individual income tax brackets and standard deduction amounts for the 2019 tax year applicable for taxes due in 2020.

DES MOINES The new Local Options Sales and Service Tax will take effect Monday July 1. The 2019 annual Tax Sale will be held by the Des Moines County Treasurer on Monday June 17 2019 in the. The Iowa state sales tax rate is 6 and the average IA sales tax after local surtaxes is 678.

Iowa City IA. What is the sales tax rate in Des Moines Iowa. It will devote of half the money to reducing property taxes.

Within a county some cities may have the local option tax and some may not. The total tax rate might be as high as 8 depending on local municipalities. Keeping accurate records of all monies received and disbursed.

Des Moines IA Sales Tax Rate. The County sales tax rate is. Sales Tax Rate Changes in Major Cities.

Iowa has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. Iowa has 893 special sales tax jurisdictions with local sales taxes in addition to the state. The state sales tax and use tax rates are the same.

View the Sales Tax Rate Chart 79-106 Local Option Sales Tax. Suite 100 Des Moines IA 50309. The Iowa IA state sales tax rate is currently 6 ranking 16th-highest in the US.

Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7. Des Moines expects to receive 37 million annually from the sales tax. This is the total of state county and city sales tax rates.

Sales Tax State Local Sales Tax on Food. The latest sales tax rate for Des Moines IA. Average Sales Tax With Local.

2020 rates included for use while preparing your income tax deduction. The Washington sales tax rate is currently. The Des Moines sales tax rate is.

Interest Rates The 2019 Department interest rate calculation is now final. Groceries are exempt from the Des Moines and Iowa state sales taxes. The average local rate is 097.

The current total local sales tax rate in Des Moines IA is 7000. The Des Moines Sales Tax is collected by the merchant on all qualifying sales made within Des Moines. Did South Dakota v.

The County sales tax rate is. Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest. Groceries and prescription drugs are exempt from the Iowa sales tax.

Des Moines IA Sales Tax Rate. Indianola IA Sales Tax Rate. Des Moines which passed a penny sales tax in 2018 lowered its property tax rate by 60 cents in 2019.

The rate is 1. Des Moines collects a 0 local sales tax the maximum local sales tax allowed under Iowa law. The current state sales tax rate in Iowa IA is 6.

There are a total of 832 local tax jurisdictions across the state collecting an average local tax of 0988. Twenty-five major cities saw an increase of 025 percentage points or more in their combined state and local sales tax rates over the past two years including 10 with increases in the first half of 2019. What is the sales tax rate in Des Moines Washington.

The minimum combined 2022 sales tax rate for Des Moines Washington is. The rate is 6. To authorize imposition of a local sales and services tax in the City of Des Moines at the rate of one percent 1 to be effective July 1 2019.

Des Moines has a lower sales tax than 931 of Iowas other cities and counties. The Iowa Department of Revenue will not seek to impose sales tax liability for periods prior to the effective date. In addition to the state sales tax most local jurisdictions impose a local option sales tax.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Contact the Iowa Secretary of State by phone at 515 281. This rate includes any state county city and local sales taxes.

2020 rates included for use while preparing your income tax deduction. The Des Moines sales tax rate is. The December 2020 total local sales tax rate was.

The average local rate is 097. Known for its rolling plains and beautiful cornfields Iowa is home to an income tax system that ranges from one of the lowest income tax rates in the country at 033 to one of the highest at 853. In order to be eligible to bid at the Des Moines County Tax Sale all tax sale bidders must complete the.

Statement of trade name on file with the Des Moines County Recorder. Rates include state county and city taxes. Dubuque IA Sales Tax Rate.

Remote sellers that meet these thresholds in the preceding year should begin collecting Iowa sales tax on January 1 2019. The latest sales tax rates for cities in Iowa IA state. The tax system is made up of nine tax brackets which.

The city plans to cut its tax rate by 60 cents for the coming year. This year the city plans to maintain its rate at 1661. The average combined tax rate is 697 ranking 27th in the.

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

Company And Personal Income Tax Rates In The Eu Download Table

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

Company And Personal Income Tax Rates In The Eu Download Table

Amazon In Its Prime Doubles Profits Pays 0 In Federal Income Taxes Itep

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

Pdf The Calculation Of Marginal Effective Tax Rates

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Company And Personal Income Tax Rates In The Eu Download Table

This Is The Most Expensive State In America According To Data Best Life

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

Property Taxes West Des Moines Ia

Property Taxes West Des Moines Ia

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies